B-end

CBDC Smart Contract Supply Chain Financial Service Platform

1.CBDC Smart Contract Supply Chain Financial Service Platform

Supply chain financial services can effectively address issues such as difficulty and high cost of financing for small and medium-sized enterprises (SMEs), revitalize the stock of accounts receivable/prepaid assets of SMEs, enhance the overall competitiveness of the industrial chain, support the development of the real economy, and guide financial funds to shift from virtual to real, returning to the essence of the industry, and practicing inclusive finance, thereby providing and creating new growth opportunities for various stakeholders.

IBDT customizes the construction of the CBDC smart contract supply chain financial service platform for leading enterprises in various industries (referred to as 'core enterprises') worldwide. By overlaying CBDC smart contracts and predefining funding channels, it enhances financing convenience for funded enterprises and enables financial institutions to achieve closed-loop fund management, effectively supporting and empowering the development of supply chain financial services.

2.Comparison between the traditional corporate lending market and the CBDC smart contract supply chain financial market:

①Traditional Corporate Lending Market

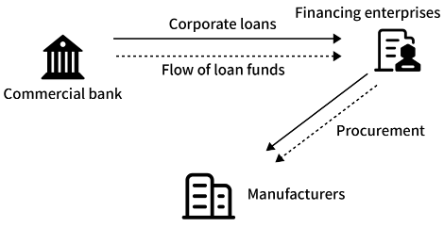

In the traditional corporate lending market, financial institutions such as banks have higher qualification requirements for financing companies. The application process is more complex and cumbersome, and there are greater demands for collateral and guarantees.

Characteristics of the traditional corporate lending market:

High Eligibility Requirements::Financial institutions, such as banks, have high qualification standards for financing companies, including stable financial history, positive cash flow, collateral, and good credit ratings.

Complex Application Process:The application process for traditional corporate loans can be lengthy and cumbersome, involving extensive documentation and requirements for collateral and guarantees.

High Borrowing Costs:Different types of funding in the traditional corporate lending market generally come with higher costs, such as interest rates and fees.

High Default Rates:The lack of control over the flow of loan funds in traditional corporate lending can result in higher default rates and risks.

②CBDC Smart Contract Supply Chain Financial Market

In the CBDC smart contract supply chain financial market, funded companies do not need to provide excessive qualification documents, financial statements, guarantees from legal representatives or actual controllers, or additional asset collateral to obtain loan financing.

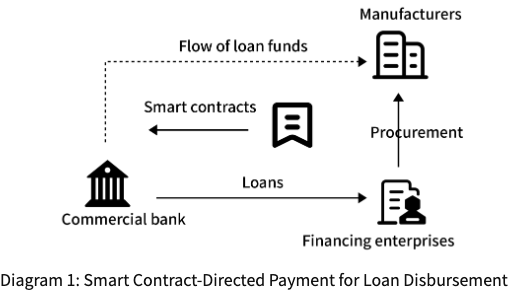

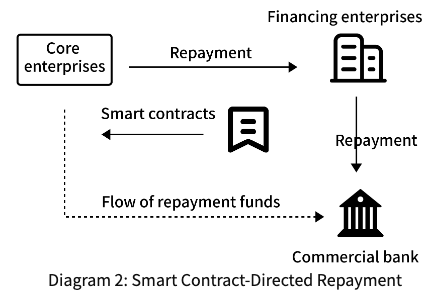

During the loan disbursement process, the smart contract controls the directional flow of loan funds, directing payment to predetermined recipients, thus avoiding the risks associated with improper use of funds by the funded companies. In the repayment phase, the smart contract triggers payments from downstream payers of the funded companies, ensuring the safe and closed-loop return of funds to the lending institution.

Characteristics of the CBDC smart contract supply chain financial market:

Improved Financial Accessibility:Lowering the loan threshold and covering all types of enterprises creates a more vibrant market.

Reduced Borrowing Costs:Streamlining the process and reducing intermediary involvement improves efficiency and lowers interest and fee costs.

Promotes Credit Evaluation:The transparent and traceable nature of smart contracts helps establish a credit evaluation system.

Risk Control:Smart contract-based loans enable control over the directional flow of funds, supporting small, frequent repayments, and reducing risks at the technical level.

The CBDC smart contract supply chain financial service platform brings significant innovation to the corporate lending market, unleashing a substantial demand and revitalizing the market dynamics of corporate loans.

CBDC Smart Contract Voucher Multi-Level Circulation Platform

IBDT serves leading enterprises in various industries worldwide, extending its coverage to their affiliated chain enterprises and financial institutions, achieving comprehensive coverage of the industrial chain. Based on this foundation, IBDT designs and builds a CBDC Smart Contract Voucher Multi-Level Circulation Platform. The platform, using CBDC smart contracts, separates the flow of funds and information, greatly reducing the cost of fund movement within the industrial chain for the core enterprises served by the platform.

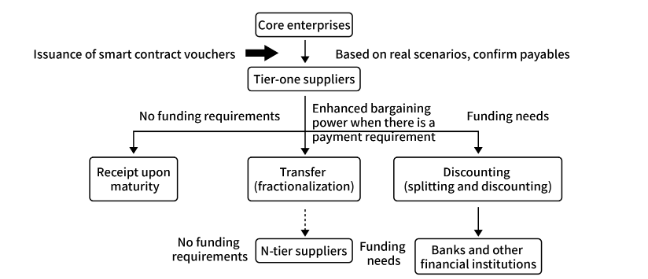

Core enterprises can confirm their accounts payable to tier-one suppliers and issue smart contract vouchers through the CBDC Smart Contract Voucher Multi-Level Circulation Platform. The vouchers are then used for payment to the tier-one suppliers. Here are the options available:

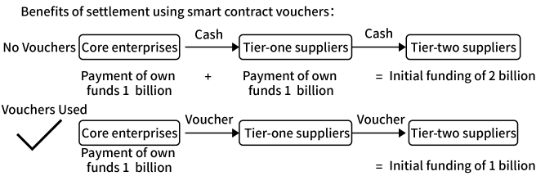

By utilizing the CBDC Smart Contract Voucher Multi-Level Circulation Platform, core enterprises can significantly reduce the cost of fund movement within their overall supply chain. The benefits of using smart contract vouchers for settlement are more evident in longer supply chains with more participating entities.

Key value points for core enterprises:

1.Integrated management of all issuing parties with customizable access.

2.Access to a wider range of financing channels (direct credit and proactive credit line resources).

3.Visualized contract circulation, enabling reach to customers along the chain.

4.Reduced capital utilization.

Key value points for suppliers:

1.Vouchers are easily divisible, facilitating smoother circulation.

2.Increased access to financing channels with lower costs, and the ability to split and discount vouchers as needed.

3.Higher level of payment security through proactive information disclosure and online clearing that allows for non-recourse settlements.

4.Reduced need for multiple accounts and streamlined online processes for improved efficiency and convenience.