Central Bank Management Layer

At the central bank management level, the following modules or functions are involved:

Policy formulation and regulation: The central bank is responsible for formulating and regulating the policy framework and rules for CBDC. Including determining the goals, issuance strategies, money supply and circulation rules of CBDC, etc., to ensure the smooth operation of CBDC and meet the goals of the central bank.

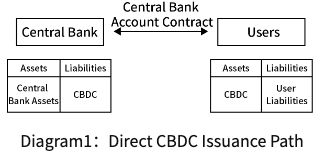

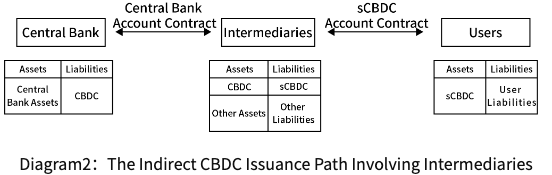

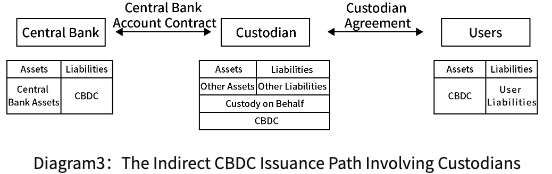

Issuance and sales: The central bank is responsible for the issuance and sale of CBDC, determining the supply, issuance methods and strategies of CBDC to ensure that CBDC can enter the market safely and efficiently.

Account Management: The central bank manages the creation and management of CBDC accounts. Includes user identity verification, KYC and account registration related transactions. The central bank cooperates with commercial banks or other financial institutions to jointly manage CBDC accounts.

Security and Risk Management: The central bank is responsible for ensuring the security and risk prevention of CBDC, formulating security strategies and standards, supervising the security of technical infrastructure to prevent fraud, data leakage and cyber attacks.

Supervision and Compliance: The central bank will supervise the operation of CBDC and ensure its compliance, formulate regulatory rules and standards, monitor the use of CBDC, and take necessary regulatory measures to ensure market stability and protect user rights and interests.

Coordination and Cooperation: The central bank needs to coordinate and cooperate with other relevant institutions, government departments, commercial banks and international organizations to ensure the smooth implementation and operation of CBDC. Involving policy consultation, information sharing and cooperation project promotion.

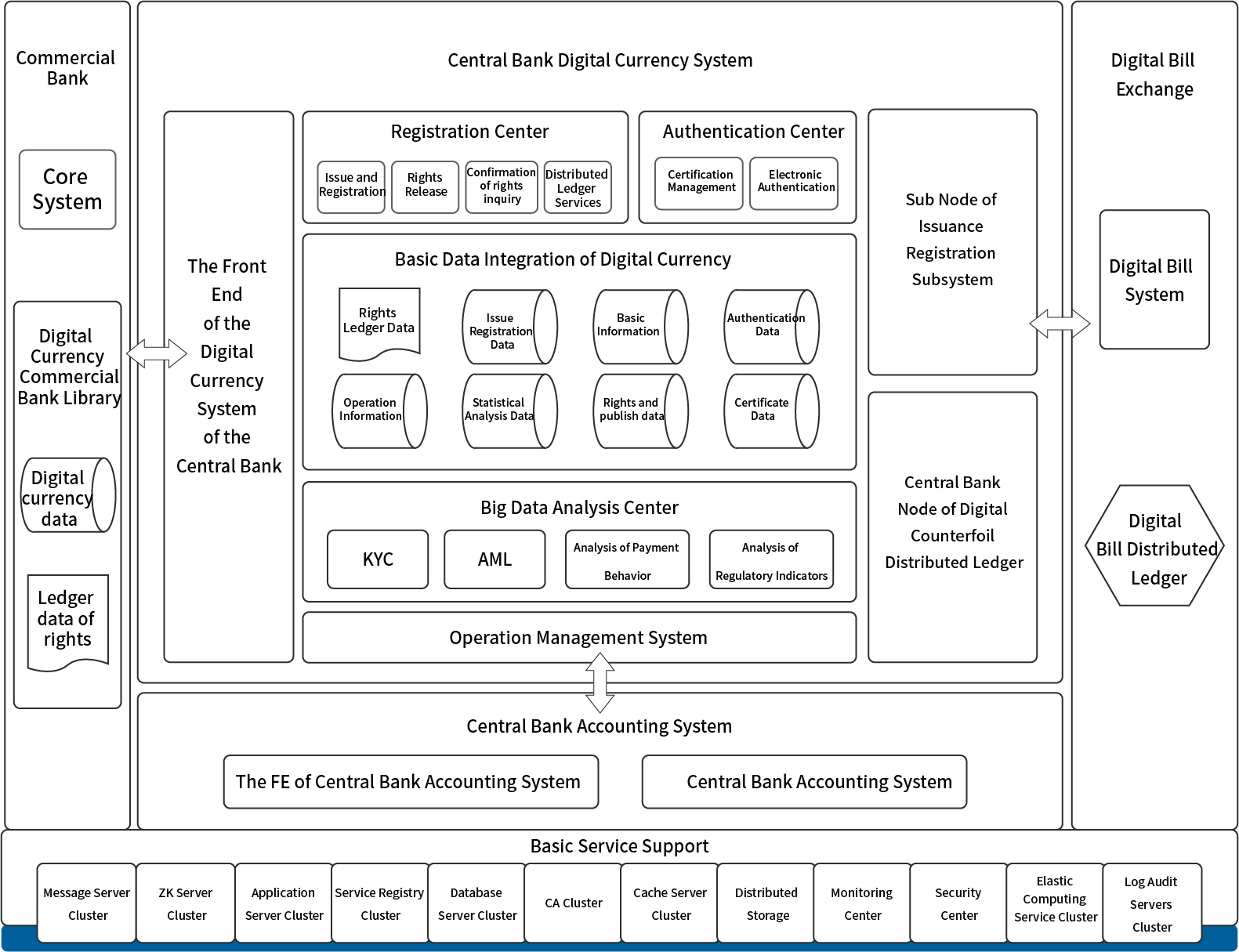

The core elements of the CBDC system are One Currency, Two databases and Three Centers.

One currency refers to the encrypted digital string representing the specific amount guaranteed and signed by CBDC.

Two databases refer to the central bank issuing database and commercial bank database, and also include the digital currency wallet (DCW) of CBDC in the circulation market.

Three Centers refer to certification center, registration center and Big Data analysis center.

Figure: The Overall Framework of the Central Bank Perspective

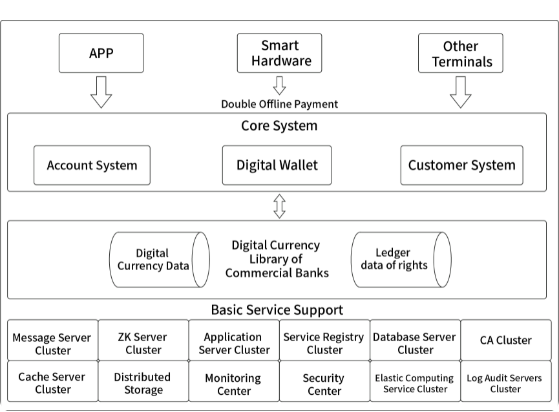

Figure: The Overall Framework of Commercial Banks Perspective